This isn’t just about plateauing subscriber numbers. I believe it’s a systemic value erosion defined by four critical factors that are actively crippling the telecom sector:

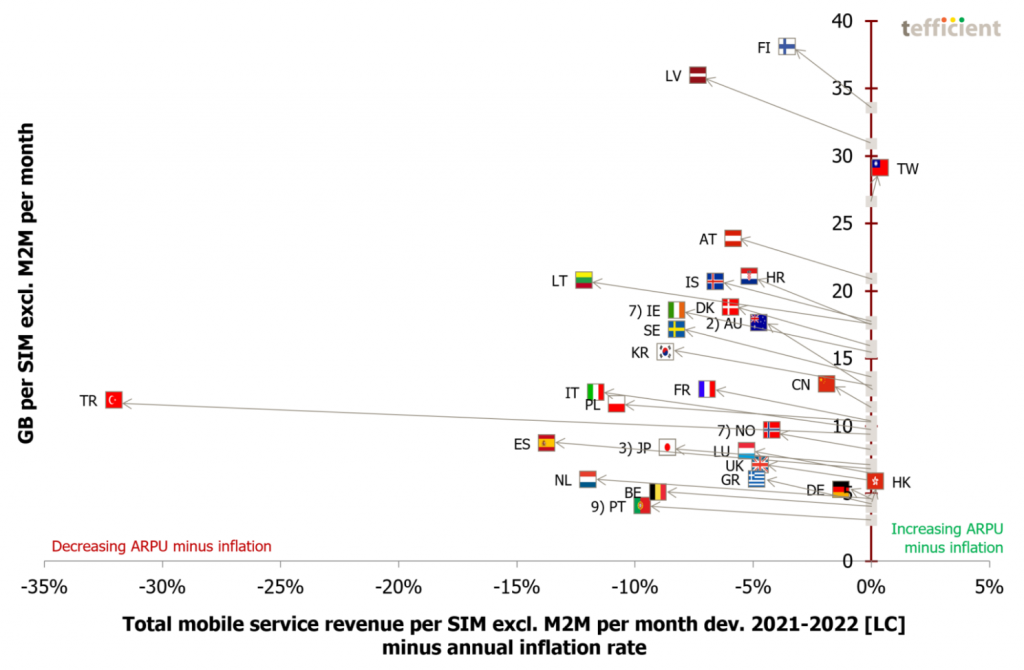

1. The ARPU deflation trap

The core business model is broken. ARPU is in a global freefall.

New, cost-intensive infrastructure like 5G fails to generate proportionate revenue, while OTT messaging and video platforms have commoditized high-value services like international calls. Telcos have been relegated to “dumb pipes”, struggling to recoup investment because the value is being captured elsewhere.

2. The great data paradox

Telcos possess the most valuable data in the digital ecosystem: deterministic, real-time, first-party information on customer behavior, device usage, and location.

Yet, they are handcuffed by regulatory bodies and strict privacy mandates (ex. GDPR, CCPA), preventing them from leveraging this asset. Meanwhile, unregulated tech giants (Google, Amazon, Microsoft) monetize aggregated, behavioral data with impunity, having cornered 80%+ of the digital advertising market.

Telcos know their customers best, but can legally do the least with that knowledge.

3. The trust deficit

The pursuit of short-term revenue is destroying long-term loyalty. Subscribers are fatigued by bulk spamming and irrelevant ads, leading to a deep erosion of trust in their carriers.

Concurrently, the skyrocketing cost of A2P messaging is alienating enterprise advertisers, who view the price hikes as predatory, but not partnership. The industry is losing trust on both the customer and B2B sides.

4. The walled garden monopsony

Advertising and customer engagement have been monopolized by a few large platforms. Advertisers are forced into these “walled gardens” not because they trust them more, but because they offer scale.

Not even a single national telco has the reach to compete with a global platform. The industry’s fragmentation is its greatest weakness in the war for digital revenue.

The solution lies in data consolidation and hyper-targeting based on AI

At afina, we believe that the key to overcoming this stagnation is not further competition, but cooperation, under the umbrella of consolidating fragmented telecom sector data into a unified and effective intellectual ecosystem.

We offer telecom operators a path to reclaim their share of the digital economy:

- Legal & ethical monetization

afina DMP is a platform built from scratch based on machine learning. During its development, key attention was paid to compliance with subscriber privacy requirements and a variety of international regulatory frameworks. We are prepared for any legal obstacles and ensure data anonymisation for usage in hyper-targeted advertising.

- The ARPU lifeline

We offer a demonstrable, zero-CAPEX path to new revenue. Through our flexible model, based on Revenue Share, operators can achieve an immediate, measurable 5% boost to their ARPU by monetizing existing subscriber databases.

- The telco data alliance

We are creating a unified ecosystem that allows operators to jointly offer advertisers unprecedented reach and verified first-party data, which is essential for competing directly with the largest tech giants.

The future of telecommunications lies not in selling more minutes or gigabytes, but in digitising and monetising data within the network itself.